What about debt? One category missing from the list above is personal debt.

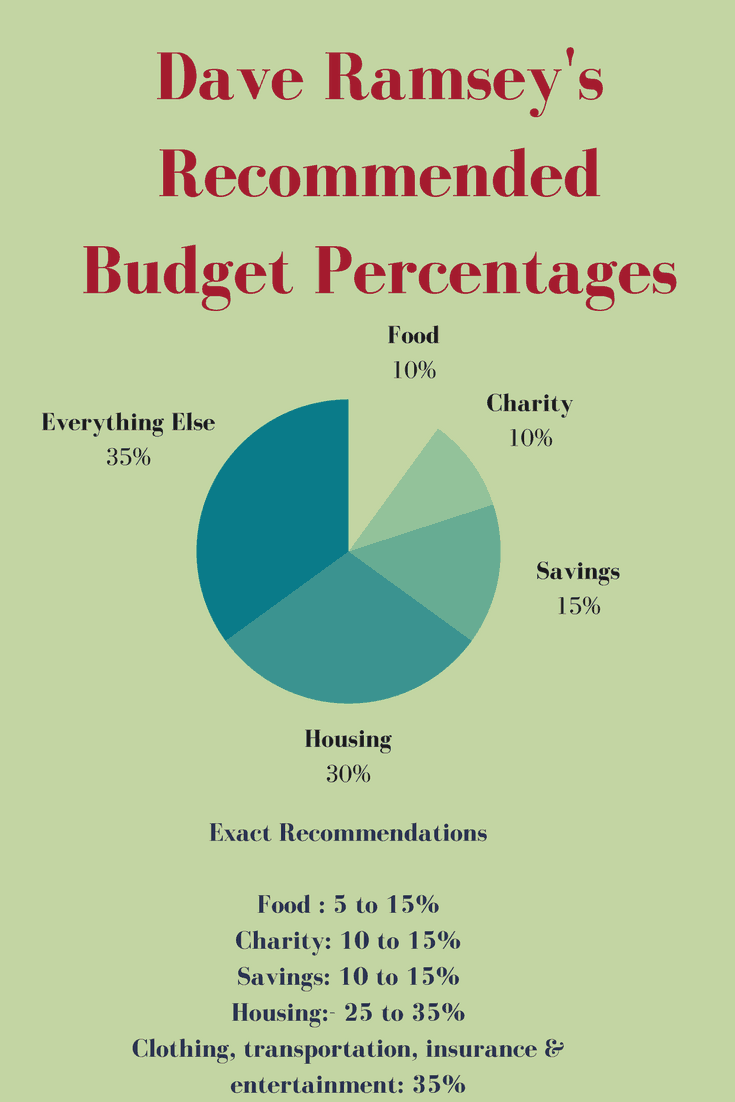

Housing costs - Rent or mortgage payment, along with property tax, home or renters insurance, home maintenance, HOA fees, and PMI.Utilities - Cell phone, cable, internet, gas, and electricity.Food - Includes both grocery shopping and eating out.Saving - Saving 10% of your income for retirement, which ideally is within a 401(k) or IRA.Giving - Ramsey recommends giving 10% of your monthly income to worthy causes.Here’s a breakdown of each category, based on Dave Ramsey’s advice: Ramsey’s 11 budget categories, along with the percentages, are: Dave Ramsey’s Recommended Budgeting Systemĭave Ramsey’s Recommended Household Budget Percentages.

#Dave ramsey you need a budget how to

How to Analyze Your Monthly Budget (and Create Your Own).Dave Ramsey’s Household Budget Percentages Analysis.Dave Ramsey’s Recommended Household Budget Percentages.

0 kommentar(er)

0 kommentar(er)